Results 9,731 to 9,740 of 10726

-

-

October 12th, 2019 11:15 AM #9732

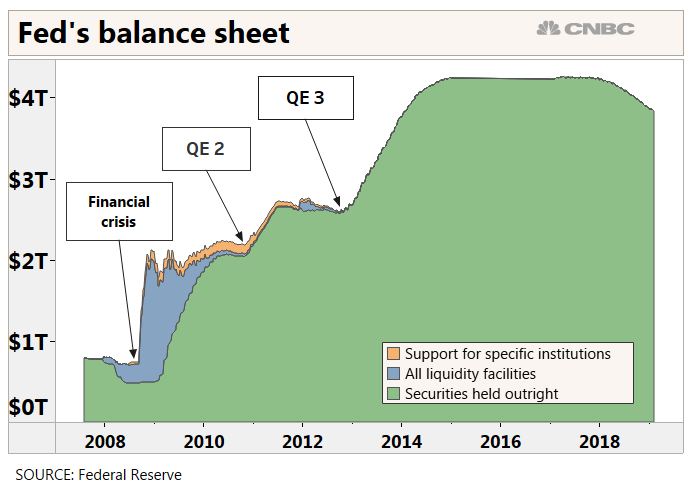

in 2018 the Fed started reducing its balance sheet (QT -- quatitative tightening) after years of balance sheet expansion (QE -- quantitative easing)

but they stopped QT a couple of months ago

why?

coz the world needs dollars

QT was destroying 50 billion dollars per month

it was slowing down the world economy

basically the Fed can't normalize its balance sheet without sending the world into recession

The Fed is stuck with its massive balance sheet

QT went too far

it resulted in inadequate reserves

primary dealers didn't have enough reserves to absorb massive US govt debt issuance

(read about last month's repo crisis)

So here we are

Not only has the Fed needed to stop QT, now the Fed needs to reverse QT

things cannot go back to normal pre-2008

QE is a drug that the world got addicted to and cannot wean itself off

THE FED CAN'T NORMALIZELast edited by uls; October 12th, 2019 at 11:19 AM.

-

October 15th, 2019 01:03 PM #9733

Hoping for the Hk$ to fall off the cliff...

Hong Kong releases up to HK$3�� billion in city’s version of quantitative easing to bolster economy against downturn | South China Morning Post

-

October 15th, 2019 01:37 PM #9734

^less money to build weapons for communist china

Sent from my SM-A520W using Tapatalk

-

October 15th, 2019 03:30 PM #9735

-

-

October 17th, 2019 04:47 AM #9737

Weak U.S. retail sales cast shadow over slowing economy - Reuters

Sent from my Mi 9T Pro using Tapatalk

-

October 17th, 2019 11:25 AM #9738

-

October 21st, 2019 10:11 PM #9739

Downgrade party...

Credit Suisse Downgrades Boeing (BA) to Neutral on Increased Risk

Sent from my Mi 9T Pro using Tapatalk

-

October 23rd, 2019 01:04 PM #9740

Fed repo: Worries continue over the efforts to fix funding issues

Wall Street is getting worried that the Federal Reserve’s aggressive efforts to control short-term borrowing rates have run into some potholes, with more danger ahead.

The central bank has been working feverishly to address issues that popped up more than a month ago in the repo market, the overnight lending place where banks go to borrow money from each other. A cash crunch led to a spike in several rates, leading the Fed to institute programs to maintain proper liquidity levels.

While the effort has worked fairly well so far — rates rose last week, though not nearly as much as in mid-September — finance professionals fear that the market problems are not fixed and funding issues can happen again.

Reply With Quote

Reply With Quote

As expected, in response to Tesla’s entry into the Philippines market, Ford will be bringing in the...

Tesla Philippines