Results 7,811 to 7,820 of 10726

-

August 28th, 2013 11:22 PM #7811

Is staying liquid for now the right thing to do??

'This is not a repeat of 1997 Asian financial crisis'

ABS-CBNnews.com

Posted at 08/28/2013 2:39 PM | Updated as of 08/28/2013 3:53 PM

MANILA, Philippines - Is emerging Asia on the brink of another financial crisis?

Standard & Poor's Ratings Services doesn't think so.

In a statement, S&P said the market turbulence is driven largely by uncertainties around the timing US Federal Reserve's taper, as well as the recent cut in growth forecasts for Asia, including China.

"The road may be rocky in the near term, particularly for the largest deficit countries — India and Indonesia — but we don't think this is the Asian crisis all over again,” Paul Gruenwald, S&P Asia-Pacific chief economist said.

He said financial markets are pricing in a different path for US monetary policy. As this happens, he noted Asian economies, including the Philippines, would likely see bouts of volatility, as well as weaker currencies, lower asset prices, and subdued sentiment and growth.

"But, in our view, this is not a repeat of the 1997 Asian financial crisis,” Gruenwald said.

S&P's chief economist noted that emerging Asian economies' external positions are much stronger, and the region’s central banks are also not defending their exchange rates.

"In addition, the increase in leverage over the past five years has been moderate in the economies with high external risks," he said.

"External financing risks arise from the financing mix of domestic investment and growth. The key metric here is the current account balance, which reflects not only exports less imports of goods and services but savings less investment."

However, economies with a current account deficit, may need to borrow from the rest of the world.

"In times of normal risk appetite, this dependency may not be a problem. However, when markets become risk averse, economies with current account deficits often find themselves facing external financing pressure,” he said.

-

-

-

August 29th, 2013 10:35 PM #7814

Russian Navy in Mediterranean... smells like World War III

Damn, son! Where'd you find this?

-

August 29th, 2013 11:50 PM #7815

Lots of unease sa Middle East thanks to Syria's alleged use of chemical weapons.. ohh.. so who'll be throwing missles first? The US? French? Probably NATO?

-

-

August 30th, 2013 09:26 AM #7817

-

September 1st, 2013 02:32 PM #7818

September is gonna be an interesting month

the US Congress told Obama he has to get their approval first before he can strike Syria and that's exactly what he did --- Obama asks Congress to OK strike on Syria ---- so an immediate strike on Syria has been postponed. Congress is on recess. they'll be back Sept. 9

there's the Fed decision on reduction of bond purchases

there's the August jobs report

there's the US budget (there are 2 upcoming budget fights. the first will be this month where Congress must pass legislation to continue funding the government. if there's no "continuing resolution" the US govt will shut down. the second will be next month where the US Treasury must get approval from Congress to raise the borrowing limit. if the limit isnt raised the US govt will default)

there's the nomination of the next Fed chairmanLast edited by uls; September 1st, 2013 at 02:45 PM.

-

September 2nd, 2013 11:05 AM #7819

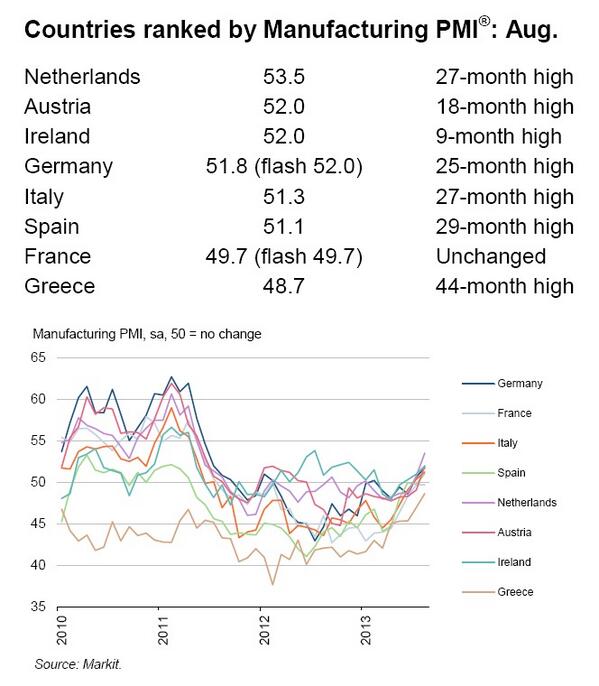

China manufacturing rebounds

http://uk.reuters.com/article/2013/0...98100U20130902

(Reuters) - China's factory activity expanded for the first time in four months in August as domestic demand rebounded, a private survey showed, a further sign that policymakers may have averted a sharp slowdown in the world's second-largest economy.

The final HSBC/Markit Purchasing Managers' Index (PMI) climbed to 50.1 in August, up sharply from July's 47.7 and in line with last week's flash reading.Last edited by uls; September 2nd, 2013 at 11:07 AM.

-

Reply With Quote

Reply With Quote

As expected, in response to Tesla’s entry into the Philippines market, Ford will be bringing in the...

Tesla Philippines