Results 9,271 to 9,280 of 10726

-

September 16th, 2018 01:08 PM #9271

-

September 19th, 2018 07:29 PM #9272

Spend like there is no tomorrow...

National debt is about to roar back as top issue (opinion) - CNN

-

-

September 20th, 2018 03:39 PM #9274

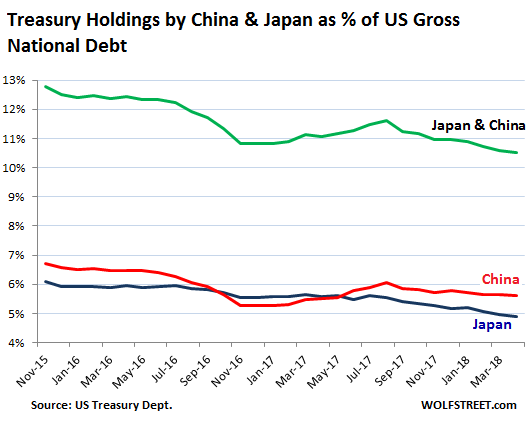

Will the trade war affect China's appetite for US treasuries...?

-

September 20th, 2018 04:11 PM #9275

Trump wants to close the trade gap with China

China sells far more stuff to the US than it buys from the US

China invests its dollar earnings in US treasuries (China is #1 foreign holder of US treasuries)

If the trade war succeeds in closing the trade gap China will have less dollars to invest in US treasuries

-

September 20th, 2018 04:32 PM #9276

China cannot retaliate against the US like for like

the US can tax more Chinese goods than China can tax US goods

so what can China do?

China can weaken its currency to counteract the effect of US tariffs

if China devalues the yuan, there will be strong demand for dollars (everybody will want to convert yuan to dollars)

in order to manage the devaluation, China will have to liquidate some of its treasury holdings

-

September 26th, 2018 04:33 PM #9277

Is this the key to end US-Dollar control of the financial system? US authorities will be blocked from knowing what, who and why the transactions are for.

Europe Finally Has an Excuse to Challenge the Dollar

Germany, France and the U.K. would set up a multinational state-backed financial intermediary that would deal with companies interested in Iran transactions and with Iranian counter-parties. Such transactions, presumably in euros and pounds sterling, would not be transparent to American authorities. European companies dealing with the state-owned intermediary technically might not even be in violation of the U.S. sanctions as currently written. The system would be likely be open to Russia and China as well.Europe would thus provide an infrastructure for legal, secure sanctions-busting — and a guarantee that the transactions would not be reported to American regulators. It would be pointless to sanction the special purpose vehicle because the U.S. would have no way of knowing who deals with it, and why. All the U.S. could do is sanction the participating countries’ central banks or SWIFT, the Brussels-based financial messaging system, for facilitating the transactions (if the special purpose vehicle uses SWIFT, rather than ad hoc messaging).

Either U.S. authorities fail to take enforcement action given the massive consequences for the operations and integrity of the American financial system, serving to “defang” the enforcement threats and reduce the risk of European self-sanctioning on the basis of fear, or U.S. authorities take such an enforcement action, a step that would only serve to accelerate European efforts to create a defensible banking architecture that goes beyond the Iran issue alone.”Creating “a defensible banking architecture” may well be the end goal for the Europeans, China and Russia, anyway. Iran is only a convenient pretext: the nuclear agreement is one of the few things that unite the EU, China and Russia against the U.S. But working to undermine the dollar’s global dominance isn’t ultimately about Iran at all. In his recent State of the European Union speech, European Commission President Jean-Claude Juncker called for strengthening the euro’s international role and moving away from traditional dollar invoicing in foreign trade. China and Russia have long sought the same thing, but it’s only with Europe, home of the world’s second biggest reserve currency, that they stand a chance of challenging American dominance.Last edited by Monseratto; September 26th, 2018 at 04:47 PM.

-

September 26th, 2018 05:17 PM #9278

because the US dollar is the most widely used most widely accepted currency in the world, it gives the US tremendous power

when the US cuts off a country or company or individual from the dollar system, that country, company, or individual can barely function

because of its effectiveness the US loves using its sanctions power

but it will lose effectiveness as the US overuses it

the world is getting tired of US bullying

as i said in another thread, US bullying power comes from its ownership of the dollar system

if the world finds an alternative currency, US power will diminish

-

September 26th, 2018 05:42 PM #9279

Bolton Warns of ‘Terrible Consequences’ for Those Doing Business with Iran - The New York Times

Sent from my SM-N960F using Tapatalk

-

September 26th, 2018 05:47 PM #9280

Reply With Quote

Reply With Quote