Results 1 to 10 of 17

-

March 26th, 2013 04:01 PM #1

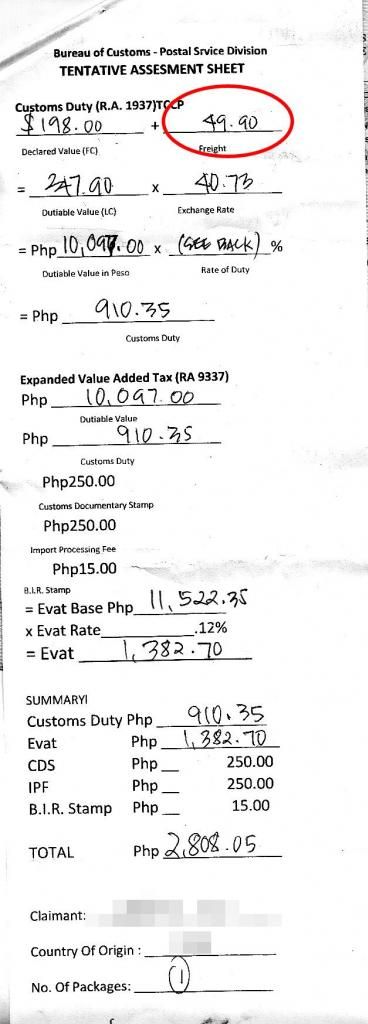

Today I just received a package from my friend sending me a few items. I kinda griped when I (again) saw that the FREIGHT CHARGE was included in the taxable value. Below you can see details. What in the name of common sense does "FREIGHT CHARGE" needs to be taxed??

-

-

March 26th, 2013 04:12 PM #3

-

March 26th, 2013 04:20 PM #4

bago sakin yang form na yan. wala naman ganyang form at freight tax 6 months ago nung nag claim ako ng computer items.

-

March 26th, 2013 04:22 PM #5

So aside from paying customs duties, you also paid tax for freight charges? The government has a very complicated taxation scheme when it comes to importing stuff thru the national post offices. Freight charges cannot be taxable, how the government or the local post office guys manage to wrangle a law taxing it is beyond my comprehension. My company is a third party certification body that deals with import and export stuff worldwide. Our Philippine operations was shuttered during the Erap administration precisely because of this red tape.

Try the private couriers next time, MBCP guys use Johnny Air with no complains AFAIK.

-

March 26th, 2013 04:29 PM #6

-

March 26th, 2013 04:34 PM #7

Unfortunately the freight charges are also included in the taxable amount. I learned this the hard way when I had a few items shipped via DHL.

You have a better chance of getting away with taxes if you use the regular postal service (USPS Priority Mail in the US), the downside is you have to wait longer (2-3 weeks) and have to pick it up at your local post office, plus the anxiety of not knowing where your item is because of the lack of tracking. It's either just a storage fee of P40 or if the Customs official assigned to your local post office is prudent, then you'll likely be paying a similar amount (which you MAY be able to haggle). I only recommend this to items that aren't that valuable.

I find it to be a lot harder (if not impossible) to contest tax charges with DHL. Wala ka halos laban kasi sobrang hirap i-contact nung naghhandle at tinataasan pa nila yung value ng items kahit totoo naman ang declared value and you'll end up waiting longer than usual until your item is delivered to your doorstep, which defeats the purpose of using their express service.

F*CK PH TAXATION!

-

-

March 26th, 2013 04:42 PM #9

-

March 26th, 2013 04:49 PM #10

Pwede, the BIR is now hell bent in bleeding the people dry. Case in point, our company had PTT (Prefferential Tax Treatment) before because of it being an ROHQ based here in the Philippines. PTT equates to just 15% tax deducted to ones monthly salary. Enter Kim Henares, and we are now languishing at 30% tax deduction every month.

Reply With Quote

Reply With Quote

As expected, in response to Tesla’s entry into the Philippines market, Ford will be bringing in the...

Tesla Philippines